A Guide to Probate for Senior Citizens and Their Families

Probate is a complicated legal process, especially for senior citizens and their families already dealing with the challenges of growing older. But fear not; understanding probate, what it means, and how to prepare for it can make life much easier during this potentially challenging time. In this guide, we’ll break down probate into simple terms, explain why it matters, and give you practical steps and tips to make the whole thing smoother for seniors and their families.

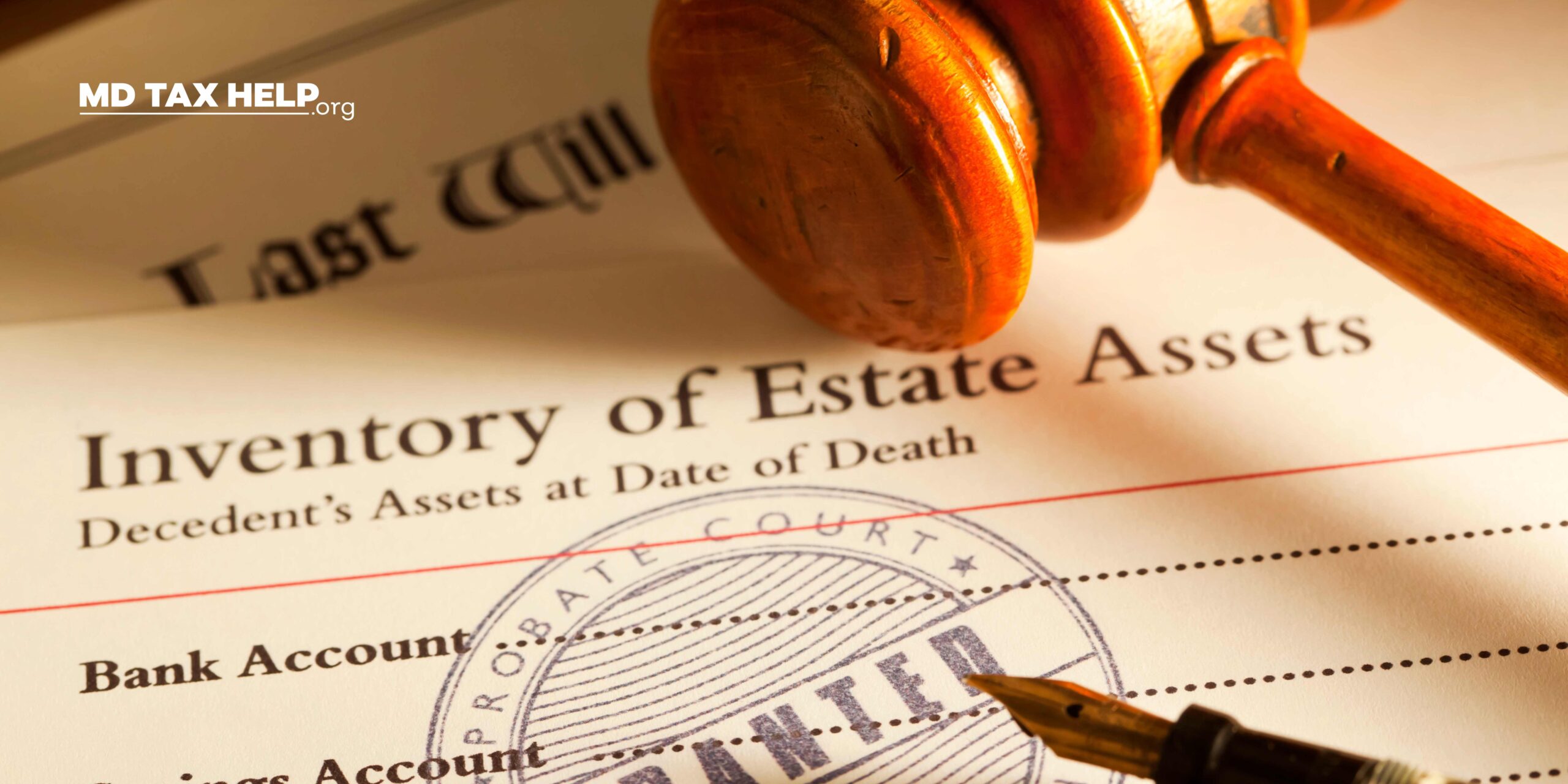

What is Probate?

Probate is the legal procedure that handles a person’s belongings after after they pass away. It involves validating the deceased person’s will (if one exists), identifying and appraising their assets, paying off debts and taxes, and distributing the remaining assets to the beneficiaries. The court ensures that this process is carried out correctly and fairly.

When Does Probate Happen?

Probate typically occurs when someone passes away with assets that need to be distributed according to a will or state law. While some assets can bypass probate, such as jointly owned property or assets held in a living trust, many estates do go through this process.

The Probate Process

Filing a Petition

The first step in probate is to file a petition with the local probate court. This is usually done by the person named as the executor in the deceased person’s will. If a will is not present, the court will choose someone to be the administrator.

Notifying Creditors and Beneficiaries

Once the court accepts the petition, the executor or administrator must notify creditors and beneficiaries of the deceased person’s estate. Creditors are given a certain period to file claims against the estate.

Inventory and Appraisal

All assets of the estate must be identified, appraised, and recorded. This can include real estate, bank accounts, investments, personal property, and more.

Paying Debts and Taxes

Outstanding debts, taxes, and other expenses are paid from the estate’s assets. This step can significantly impact the amount left for beneficiaries

Distributing Assets

Once all debts and taxes are settled, the remaining assets are distributed to the beneficiaries according to the deceased person’s will or state law if there is no will.

Strategies for Senior Citizens and Their Families

Navigating probate can be complicated and time-consuming, but there are strategies seniors and their families can use to simplify the process and reduce potential challenges:

Create a Comprehensive Estate Plan

Seniors should work with an attorney to create a well-drafted will and consider using trusts to avoid probate for certain assets. Estate planning can help minimize the assets subject to probate and ensure their wishes are carried out.

Open Communication

Open and honest communication among family members is crucial. Ensure that your loved ones know your wishes, have access to important documents and know who to contact when the time comes

Consider Joint Ownership

Consider joint ownership with a spouse or trusted family member for assets like homes or bank accounts. This can simplify the transfer of ownership after one passes away.

Consult with an Attorney

Seek legal advice from an experienced estate planning attorney who can guide you on structuring your estate to minimize probate involvement.

Review and Update Regularly

Estate plans and wills should be reviewed and updated regularly, especially after significant life events like marriage, divorce, or the birth of grandchildren.

Probate can be challenging and time-consuming,

but with careful planning and communication, seniors and their families can navigate it successfully. Creating a comprehensive estate plan, seeking legal advice, and staying organized are key steps in making the probate process more manageable. By taking these proactive measures, seniors can provide their families peace of mind during difficult times.

If you or a loved one require assistance with probate estate planning or have any questions related to Maryland tax matters, contact MD Tax Help today at (240) 704-7773. Our experienced team is here to provide you with the guidance and support you need during this important process.